Getting a housing loan in Malaysia can be tricky, but with the right tools and info, you can pick options that save you cash and fit your budget.

This guide gives you useful tips for getting the best housing loan interest rate in Malaysia with minimum interest rates. It also shows you important online house loan calculators for planning your money.

So, whether you're a first-time buyer or want to refinance, here's what you need to know to get the best housing loan interest rates in Malaysia.

Before securing a housing loan interest rate in Malaysia, there are certain things you need to understand. This will also help you in finding the best interest rate for your home loan.

Discover Your Loan Eligibility and Housing Loan Interest Rates: Compare Offers from 20 Malaysian Banks

Before entering the housing market, it's important to know what you can afford. A FinDoc Pro Report provides pre-approval insights from the top 20 banks in Malaysia.

Although house loan eligibility in Malaysia is calculated using your income, debts, and other financial responsibilities, repayment capability is only one of the considerations for loan approval. FinDoc Pro Report uses a sophisticated algorithm to calculate your loan approval across 20 banks in Malaysia.

To get a comprehensive understanding of How to Secure a Home Loan Approval More Easily – The 5Cs in Credit Approval, click here.

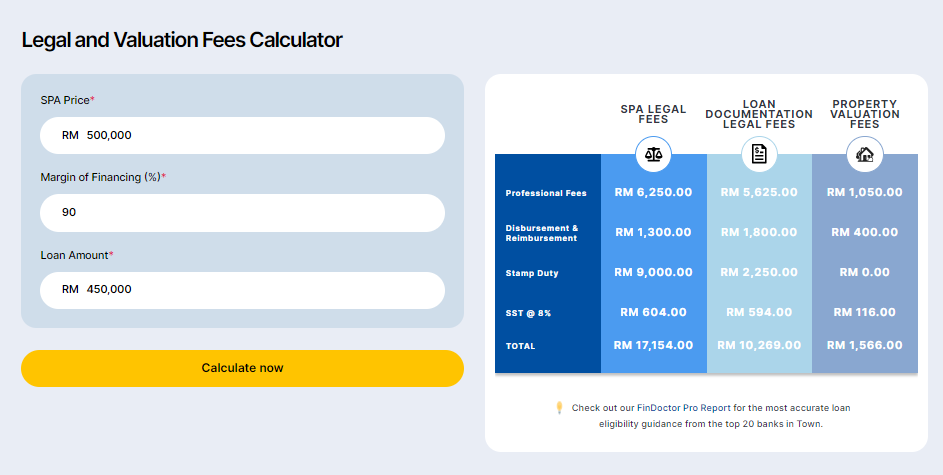

Estimate Legal and Valuation Fees: Use FinDoc Calculator for Precise Financial Planning

Additional costs, such as legal fees and property valuation fees, are part of the property purchasing process. These can increase your overall budget.

A Legal and Valuation Fees Calculator helps you estimate these expenses, allowing for more accurate financial planning. It's crucial to understand all the upfront costs involved in acquiring a home.

For more information about the detailed calculation of SPA, Stamp Duty Malaysia, and Legal Fees for Property Purchase in 2024, click here.

Calculating Available Capital: Essential Financial Planning Tips for Home Buyers

Buying a house demands a considerable initial capital investment. Therefore, you must accurately calculate your available capital to avoid cash flow problems.

For our real case study on Financial Planning Before Buying a Property, click here.

Click here for A Comprehensive Guide on 17 Easy ways to Withdraw from Your EPF (KWSP) in Malaysia.

To learn more about Real Property Gains Tax (RPGT) in Malaysia, click here.

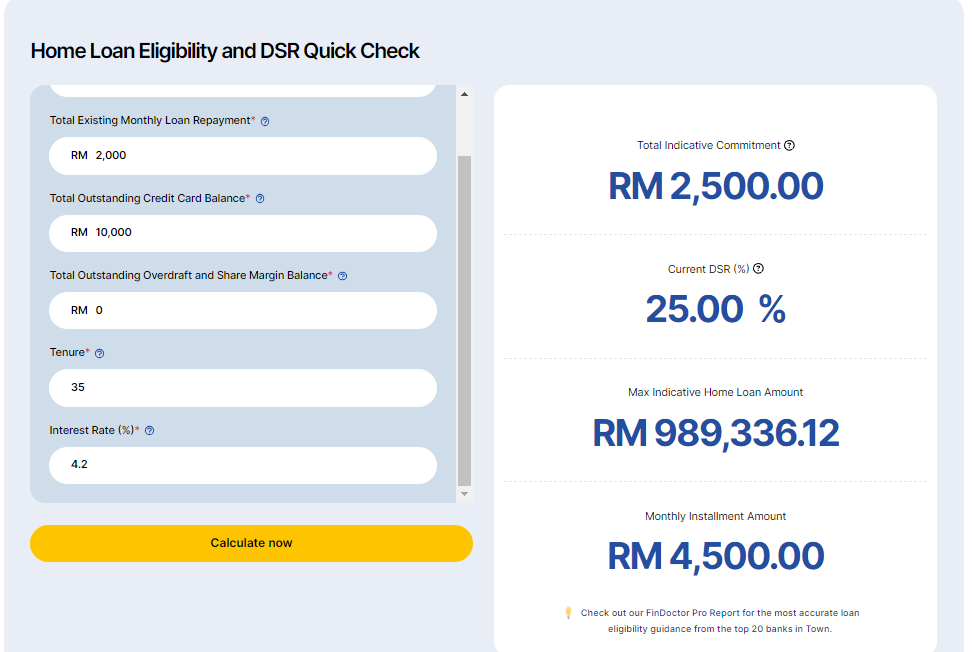

Plan Your Mortgage Payments: Essential Tools for Budgeting and Financial Planning

Knowing your monthly mortgage payments is crucial for budgeting and financial planning. A Home Loan Eligibility and DSR Calculator can help you determine these payments, including the debt service ratio against your net income.

Various factors may cause your mortgage interest to be higher than others, resulting in increased installments that could cost hundreds of thousands of ringgit over time.

For insights on the Factors Affecting Your Housing Loan Interest Rate, click here.

Here are some strategies to help secure the most favorable house loan interest rate in Malaysia, just using financial tools:

Improve Your Credit Score:

A higher credit score can significantly lower your loan interest rates. Enhance your credit health by ensuring timely bill payments, reducing debt levels, and routinely checking your credit reports via a FinDoc Pro Report from FinDoctor.my.

For further guidance, check out our guide on How to Increase Your Credit Score, Here.

Choose the Right Bank:

Different banks have varying risk appetites, so your profile might secure a better housing loan interest rate with one bank over another. It's crucial to choose the bank that best matches your profile, especially for housing loans with tenures of up to 35 years. Applying with the wrong bank could cost you hundreds of thousands due to a higher interest rate.

Some of the best options to consider are the Maybank house loan, Public Bank house loan, CIMB house loan, RHB house loan, Bank Rakyat house loan, and Government Loan for houses.

Refer to the FinDoc Pro Report here to see which bank can offer you the best housing loan interest rate and ensure you're getting the best deal.

Engage with the Right Platform or Bank Officer:

Negotiating a better loan interest rate can often be facilitated by a supportive bank officer, especially if you have a strong credit profile and other bundled applications like mortgage insurance.

If you need more clarification about the next steps, sign up for FinDoc Pro Advisory now to get personalized financial advice, debt management, interest reduction, loan settlement guidance, and tailored bank product recommendations, in addition to the Pro Report.

Credit and finance play a significant role in our lives. Making sound financial decisions and avoiding bad debts to achieve our financial goals is crucial.

To learn more about How to Transform Bad Debt into Good Debt, click here.

Securing the best housing loan interest rate in Malaysia requires a combination of using appropriate financial tools and implementing effective strategies.

By understanding your financial situation with the help of house loan calculators and adhering to our expert tips, you can confidently and economically navigate through the loan process.

Can I secure a loan even after being blacklisted in Malaysia's CCRIS and CTOS?

Even with a block on Malaysia's CCRIS and CTOS, improving your credit record is possible. This involves settling debts, negotiating with banks, and making timely repayments. A financial advisor can help rectify blocklist issues and avoid loan rejections. For more on securing loans despite CCRIS and CTOS blocks in Malaysia, click here.

How can a homeowner survive increasing loan interest rates?

Homeowners can manage rising interest rates by understanding their implications, calculating their impact, and adopting strategies such as debt consolidation, using the Employees Provident Fund, and optimizing rental returns. This adaptation can mitigate the negative effects and create wealth-building opportunities. For more detail, refer to Surviving Increasing Interest Rates - A Homeowner's Guide.

How does Bank Negara's OPR affect my loans in Malaysia?

Changes in the OPR directly affect borrowing costs. Higher OPR leads to increased housing loan interest rates, while lower OPR results in cheaper loans. Read more about how Malaysia's OPR affects your loans here.

Should I rent or buy a home?

Deciding to rent or buy a home depends on your financial stability, long-term plans, and the local housing market. Buying is wise if you're financially secure, planning to stay, and the market is favorable. Otherwise, renting may be less risky and more flexible. Click here for a comprehensive guide.

What should I do with a mortgage after a sudden family loss?

In case of sudden family death, steps to manage the deceased's mortgage involve checking for mortgage insurance, like MRTA or MLTA in Malaysia, which can clear the outstanding loan. The family can decide to continue or discontinue the mortgage, requiring either estate management rights or allowing bank repossession. Considerations include beneficiary status, property value, financial capacity, and residency. For more details, refer to the Comprehensive Guide.

When is the perfect time to sell my property to maximize profits in real estate?

The ideal time to sell property varies by investment strategy. Short-term investors buy low and sell high quickly during market swings. Medium-term investors earn steady rental income and sell in a favorable market. Long-term investors value rental return and rarely sell. The best approach depends on financial goals, risk tolerance, and market insight. More details can be found in this article.

Should I purchase a high-rise property or landed property?

Deciding to buy a high-rise property involves considering factors like location, amenities, potential yield, and lifestyle preferences. They can be a good investment in urban areas, but maintenance costs and property management are important considerations. Thorough research and professional advice are vital.

Read the Top 10 crucial factors for your next high-rise apartment purchase.

Which is a better investment in Malaysia - Real Estate or Stocks?

Choosing between real estate or stocks in Malaysia hinges on financial goals, risk tolerance, knowledge, and time.

Real estate can provide steady income, value appreciation, and tax benefits but requires substantial initial cost and upkeep.

Stocks offer high returns and liquidity with less initial capital but are subject to market changes and need stock market understanding.

Balancing your portfolio with both is recommended for balanced risk and return.

For more, view Real Estate vs. Stocks in Malaysia

How can I handle abandoned property purchases in Malaysia to survive real estate nightmares?

To handle abandoned property purchases in Malaysia, conduct due diligence before buying to avoid such projects. If already purchased, you may need to take legal action against the developer or seek government help. Join or form a buyers' group for collective action and stay updated with the developer and local authorities. For more, read the full article.

Stay Informed with Findoctor.my

For the latest financial updates and more, follow us on Facebook @Findoctor.my